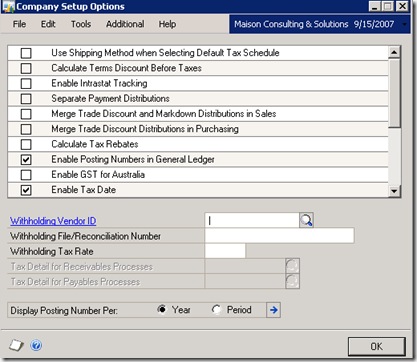

Explaining GP 10 Company Setup Window

|

|

| Use Shipping Method When Selecting Default Tax Schedule | During Tax calculation if it is required to have multiple taxes for different states, this option is very helpful. e.g. if shipment is for CA, it will deduct CA state Tax, if it is for NY, it will deduct NY Tax |

| Calculate Terms Discount Before Taxes | If taxes doesn't support Term Discounts, Amount to be calculated on Total and not on discounted amount |

| enable Intrastat Tracking | If wants to track Intrastat enable this |

| Separate Payment Distributions | if GL is required to keep track of transactions for each module entry, mark this option for payment GL accounts to keep additional record |

| Merge Trade Discount and Markdown Distributions in Sales | If you don't mark this option, the distributions that are of the same type with the same account number will be combined. (Suggested to keep it un checked for Pakistan) |

| Merge Trade Discount Distributions in Purchasing | If this option is not marked, the trade discounts and markdown distributions will e separated from the sales Distribution |

| Calculate Tax Rebates | Mark This option to allow correcting tax amounts for a transaction with a terms discount |

| Enable Posting Numbers in General Ledger | Use this option if you want solid numbering of Transactions, without gaps, solid numbering is a legal requirements in few countries |

| Enable GST for Australia | Enable GST for Australia |

| Enable Tax Date | If tax date is different from the document date, you can check this option and a tax date field will be available on all control documents |

| Enable Reverse Charge Taxes | Helpful for negative taxation, like withholding tax |

| Calculate Taxes in General Ledger | option available if paying without BR module and wants tax calculation in GL |

| Allow Summary-Level Tax Edits | if editing allowed in summary windows, check this option |

| Require Tax Details totals to Match the Pre-Tax Amount | If proposed and actual is same mark this |

| Specify Tax Details for Automatic Tax Calculation | if multiple taxes are assigned, you may select which tax to be activated |

| Enable EU Transaction Tracking | for Enabling EU Transactions |

| Enable DDR and European Electronic Funds Transfer | for EU |

| Enable Canadian Tax Detail | for Canada |

Withholding Vendor ID:

specify which vendor to Act as Tax Authority

Withholding File/Reconciliation Number

Withholding Tax Rate

Default 3.5% in case of Pakistan

Display Posting Number Per: Year or Period

2 comments:

This method doesn't calculate specified withholding tax at the time of payment e.g if withholding tax rate is 3.5%, system calculates approx. 3.12%

Do you have any idea that why is it like that?

Hi,The risk is greater if loans have been taken out from Qatar-based banks with Registered Agents in Qatar rather than home-country ones.Thanks....

Post a Comment